Unsecured personal loans for home improvement projects. No minimum credit score, no income limits (minimum or maximum), and no minimum asset or home equity required.

Unsecured Loan Products & Rates*

$25,000

Fees apply depending on improvement. Origination Fee: 2.5% and 1.25% for military discounts + Project Management Fee: 2.75-2.99%.

Eligibility

- Applicant(s) must be the OWNER of the RESIDENTIAL subject property. Immediate family members like children, parents, siblings, grandchildren or grandparents are also eligible to apply with the home owner(s) to finance improvements on their behalf.

- Home must be located in: Florida, Alabama, Georgia, South Carolina or Tennessee

- All parties to the mortgage on the RESIDENTIAL property must apply

- All titleholders to the RESIDENTIAL property must apply

- Applicant(s) must prove ABILITY TO PAY (i.e., Employment, Social Security, Disability, etc.)

- Property Taxes must be current

- Home Mortgages, auto loans, and credit cards must be current. (with proof if private mortgage)

- Applicants cannot have filed bankruptcy or have had a bankruptcy discharged in the past 12 months

- Co-signer and/or cash guarantee (i.e. 3% of total project cost) may be required depending on the Applicant(s) credit history.

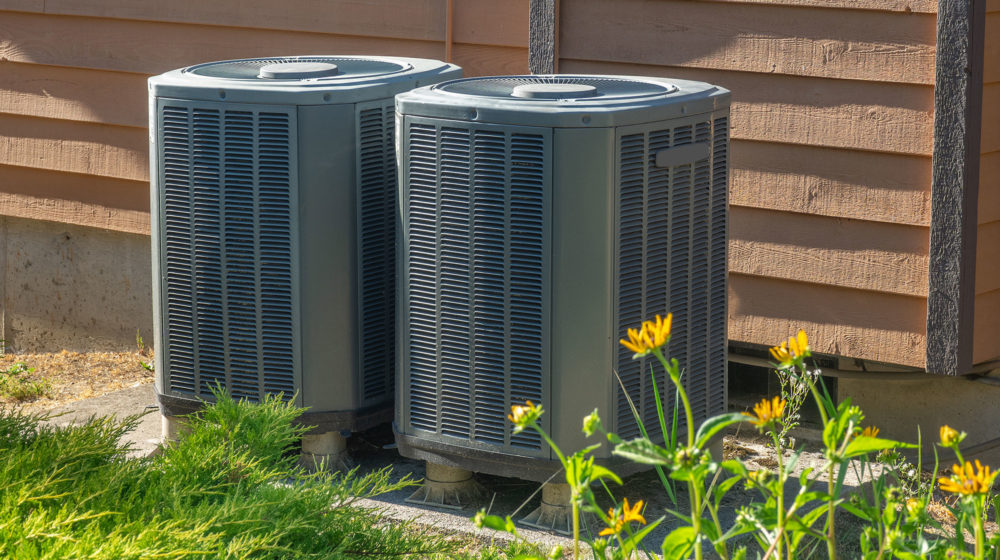

Eligible improvements include Energy Efficiency and Conservation or Renewable Energy projects other than solar PV. (e.g., high-efficiency A/C, tankless water heaters, insulation, solar attic fans, solar water heaters, solar AC, etc).

Make your home safer, greener and more comfortable with a home improvement loan from SELF!

Project Management: From Start to Finish

SELF provides project management through a robust network of pre-approved contractors. SELF oversees each project from start to finish, including pre-screening any out-of-network contractors to verify applicable licenses, insurance, and a good track record. Additionally, SELF reviews quotes to prevent price-gouging and guarantees each homeowner is satisfied before contractors are paid.

Frequently Asked Questions

What are the eligibility requirements?

- Proof of home ownership

- Proof of income

- Ability to repay the loan

- Mortgage paid on time in the past 90 days

- Current on all local property taxes

- No minimum income required

- No minimum credit score required

Success Stories

Betty Oliveras, Tampa

"I recommend SELF to everybody who falls on bad times. If they can help you, they will. And if they can't, they will try to find you somebody who can."

Ruth Vernon, Tampa

SELF helped Ruth completely redo her bathroom. "Now my daughter doesn’t have to worry about me falling"

Carolyn

“I cannot believe that I was approved after being rejected so many times by banks! I am so happy!! Thank you!”