Special Program for disabled homeowners or households with disabled members living in the home. No minimum credit score, no income limits (minimum or maximum), and no minimum asset or home equity required.

Loan Products & Rates*

$25,000

Fees apply depending on improvement. Origination Fee: 2.5% and 1.25% for military discounts + Project Management Fee: 2.75%.

Eligibility

- Applicant(s) must be the OWNER of the RESIDENTIAL subject property. Immediate family members like children, parents, siblings, grandchildren or grandparents are also eligible to apply with the home owner(s) to finance improvements on their behalf.

- Proof that the homeowner or a household member has a disability

- Home must be located in: Florida, Alabama, Georgia, South Carolina or Tennessee

- If Primary Applicant is married then the spouse must apply

- All titleholders to the RESIDENTIAL property must apply

- Applicant(s) must prove ABILITY TO PAY (i.e., Employment, Social Security, Disability, etc.)

- Property Taxes must be current

- Home Mortgages, auto loans, and credit cards must be current. (with proof if private mortgage)

- Applicants cannot have filed bankruptcy or have had a bankruptcy discharged in the past 12 months

- Co-signer and/or cash guarantee (i.e. 3% of total project cost) may be required depending on the Applicant(s) credit history.

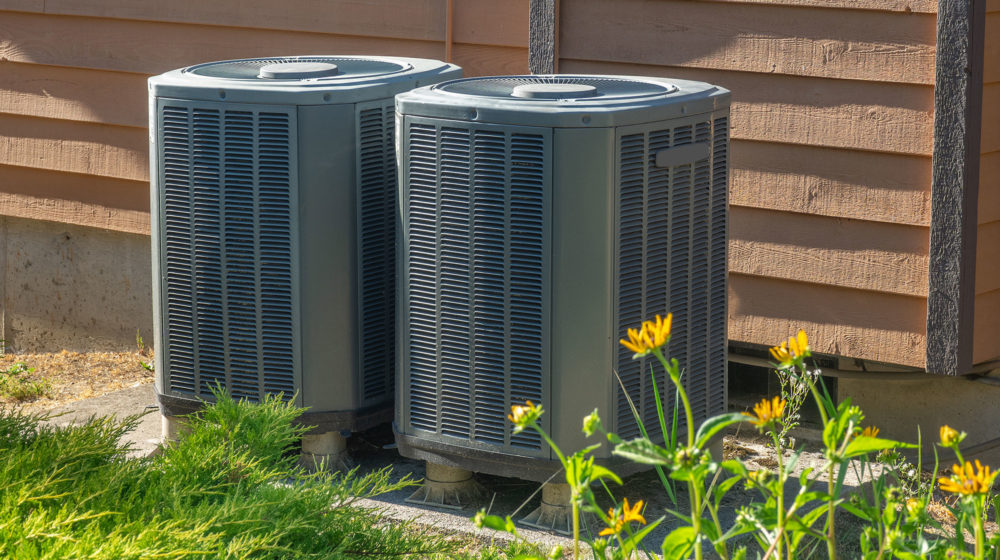

Eligible improvements include high-efficiency A/Cs, disability products and home adaptations (e.g., wheelchair ramps and walk-in showers), and assistive services and technologies.

Make your home safer and more comfortable with a HALO Loan from SELF!

Project Management: From Start to Finish

SELF also provides project management from start to finish, including: pre-screening all contractors to verify applicable licenses, insurance and a good track record; reviewing quotes to prevent price-gouging; and, coordinating with local building officials and homeowners before making final payment to the contractors.

Frequently Asked Questions

What are the eligibility requirements?

- Proof of home ownership

- Proof of income

- Property taxes must be current

- Ability to repay the loan

- Mortgage paid on time in the past 90 days

- Current on all local property taxes

- No minimum income required

- No minimum credit score required

What if my income is insufficient to repay a loan?

You may be required to add a co-signer and/or you may need to provide a small cash guarantee

Can SELF loans be used to supplement grant funds, such as SHIP, CDBG, FEMA?

Yes. SELF can supplement any grant funds by providing a loan for the homeowner to be able to complete a project. For example: A client needs $7,000 for a roof repair and is granted $3,000 from SHIP funds for home repair. The client can be referred to SELF for a $4,000 loan to supplement the SHIP grant. If the client is approved, they will be able to complete the entire project and only pay principal and interest on the amount financed by SELF.