Announcements

Financing Climate Solutions & Job Creation

SELF CFO testifies before Congress on the benefits of a clean economy Accelerator

On Thursday, July 29, 2021, Duanne Andrade joined colleagues in the banking and climate finance sector to testify before the House Select Committee on the Climate Crisis about job creation in the clean energy economy. Andrade testified on the need to invest in clean energy and resilience and how we can scale and benefit communities in an equitable way.

SELF’s ally, the Coalition for Green Capital shouted out Duanne’s testimony in the following tweet.

Coalition for Green Capital tout’s SELF CFO, Duanne Andrade’s testimony

You can watch the full hearing here: The House Select Committee on the Climate Crisis July 29th Hearing: Financing and Climate Solutions Job Creation.

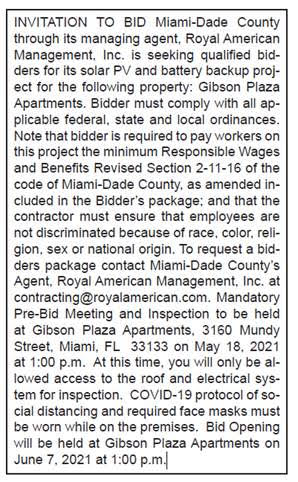

Invitation to Bid: Solar PV & Battery Back-up

SELF is working with the Leon Lowenstein Foundation, and Miami-Dade County on “Gib-Sun” Plaza: Delivering environmental and social justice through solar PV in low-income housing. The plan is to install solar panels on a five-story apartment building for low-income seniors in the heart of Coconut Grove. The Lowenstein Foundation provided a $153,000 grant via the American Green Bank Consortium to purchase the solar panels and pay for the installation. Miami-Dade County is committing up to $500,000 to install a new “solar-ready roof” to replace the old roof and provide long-term structural support for the solar PV system. For more read the full press release here.

The County is seeking qualified contractors to bid on the solar and roofing project. For more information, see details in the Invitation to Bid below.

2019 Highlights

SELF ended its 9th year of operations with some exciting achievements and new opportunities that we are pleased to share with you. We would like to thank all of our investors, grantors and supporters for trusting us and helping us make our communities more sustainable and resilient, one home at a time.

Results:

- SELF’s loan activity grew 71% reaching an all-time record of $2.6 million in new loans.

- To date, SELF has helped 1,157 homeowners across Florida make multiple home improvements related to energy efficiency, clean (solar) energy, climate resilience and home adaptations for people with disability. In 2019 it also helped 37 homeowners in South Carolina.

- Over 77% of SELF clients are low-to-moderate income; 50% are women; 15% U.S. Veterans; 54% are elderly, and 10% of total loans deployed to date have been for people with disability.

- Energy efficiency upgrades have helped SELF clients save an average 26% on energy bills and overall, clean energy improvements have helped avoid over 1,000 metric tons of CO2 emissions into the atmosphere.

- SELF increased its total assets and net assets by 21% and ended with an operating surplus of $219,000.

- SELF increased its active loan portfolio by $1 million, helping increase our self-sufficiency to just shy of 60%

Expansion

SELF purchased a loan portfolio in South Carolina with 37 loans worth $223,000 from our partner MyStrongHome, to begin serving neighboring states vulnerable to climate impacts. SELF also exceeded $ 1million in lending in the Tampa Bay region with the support of the City of St. Pete and Hillsborough County who continue to support SELF’s operations.

Grants

SELF received a $5 million grant award from the JPMorgan Chase Pro-Neighborhood Competition as part of a collaborative, to implement the “South Florida Housing Link Plan” developed by the South Florida Community Land Trust. The project aims to ensure affordable housing options in perpetuity along the new railway transit stations being developed in South Florida. The collaborative comprised by SELF, the South Florida Community Land Trust, Enterprise Community Partners, South Florida Community Loan Fund, and the Palm Beach County Community Land Trust, will leverage the grant to $75 million in investments for 300 energy efficient and sustainable new and rehabbed affordable housing units. In addition, SELF will deploy 200 loans in South Florida and develop new loan products for “green” affordable housing rehabs and new construction in the next 3 years.

CDFI Fund Award

SELF was awarded $402,000 from the CDFI Fund to help provide low cost loans for disability modifications and green upgrades to people low-and-moderate income homeowners and people with disabilities. *The award was announced after the end of the FY 2019 and is not reflected in the current year end financials.

Awards

Sustany Foundation in Tampa, Florida awarded SELF a Sustainable Business award in the Private-Public Partnership category.

Mission related

SELF participated in the “Social Justice and Green Banks” panel at the first American Green Bank Summit in Washington D.C.

New Business

SELF signed a multi-year service contract with Martin County to help LMI communities make sustainable home improvements. SELF also developed a new septic-to-sewer conversion loan to help preserve the water quality in our communities.

Contractors

SELF grew its contractor network to over 350 contractors across the State of Florida.

Financial

SELF grew its assets and net assets 21% from last year and increased its total active loan portfolio by $1 million. SELF also closed its first $1 million line of credit with Bank United and renewed $650,000 in loans from our socially responsible and faith based-investors.

We are excited to introduce our new look!

When the non-profit Solar and Energy Loan Fund (SELF) started in 2010, we wanted to support energy efficiency and clean energy solutions in underserved communities in Florida. Overtime SELF realized we needed to do much more to help low- and moderate-income homeowners. For the past 9 years, SELF has embraced the needs of our customers and expanded our lending products to finance sustainable home improvement projects, including high-efficiency A/Cs; solar technologies; roofs, hurricane shutters and impact windows; wheelchair ramps; water quality; and, much more. With over $8 million in loans for more than 1,000 homes, we are ready to go to the next level!

With our new logo, SELF confirms our commitment to mission-driven lending and sustainable home renovations that are “Rebuilding and Empowering Underserved Communities” in Florida and beyond.

SELF and St. Pete Partner on Clean Energy, Sustainability and Resilience

St. Petersburg makes $300,000 seed grant to support sustainable home improvement

ST. PETERSBURG, Fla (9 Nov. 2017) — The non-profit Solar and Energy Loan Fund is excited to announce a major new partnership with the City of St. Petersburg to enable SELF to establish a satellite office in the city and hire a full time staff person to assist local residents.

The City of St. Petersburg is a national leader on clean energy, sustainability, and financial inclusion, and was the first local government in Florida to join the Sierra Club’s Ready for 100 campaign and pledge to power the community with 100 percent clean, renewable energy.

St. Pete Mayor Rick Kriseman said, “The City is creating a roadmap to achieve our long-term sustainability goals, and we are working towards 100% clean energy to ensure that St. Pete remains a city of opportunity where the sun shines on all who come to live, work and play.”

City Council Chair, Darden Rice, added, “St. Pete’s commitment to sustainability and resiliency shows we lead the way in strategic economic development, smarter infrastructure investments, long-term planning, and measurable quality of life improvements for everyone. It enhances the identity of our city and tells the world we are serious about clean energy solutions.”

SELF is a unique community-based lending organization focused on financing sustainable home renovations that help rebuild and empower low- and moderate-income communities. SELF provides homeowners with access to low-cost financing for energy efficiency upgrades, clean energy alternatives, and wind resilience. To date, SELF has helped more than 700 families finance $6 million in home improvement projects in 63 jurisdictions in Florida, with more than 2/3 of the lending activity in low- and moderate-income census tracts, 50% for seniors, 40% for women, and 20% for veterans. SELF also helps local general contractors and energy companies finance more projects at a reduced cost.

SELF’s Executive Director, Doug Coward, said, “Our mission-driven lending programs help underserved and underbanked communities gain access to microloans with favorable interest rates to finance sustainable home improvement projects.”

SELF’s Chief Financial Officer, Duanne Andrade, added, “SELF is helping low wealth and working class neighborhoods increase home equity, storm resilience, comfort, and livability, while also reducing operating costs and reliance on predatory lenders.”

The City has committed BP Oil Spill settlement funds to develop an Integrated Sustainability Action Plan, as well as a seed grant for SELF to establish service in St. Pete. SELF will also leverage city resources with several million dollars in low-cost loan capital from faith-based organizations, banks, and private investors in order to finance a minimum of $3 million of sustainable home renovations in the city over the next 3 years.

Sharon Wright, Sustainability & Resiliency Manager for the City of St. Petersburg, said, “The City is taking major steps toward mitigating climate change and framing resiliency around social equity and economy, and SELF will help poor and working class families participate and benefit from these initiatives and opportunities contributing to our overall resiliency efforts.”

For more information about the City of St. Petersburg’s Integrated Sustainability Action Plan, please call (727) 551-3396 or visit https://www.stpete.org/sustainability/building_energy.php